- GoTab Help Center and Knowledge Base

- Finance & Accounting

-

Getting Started

-

Server Training

-

Menu Management

-

POS

-

Kitchen Display System

-

Integrations

-

Managing your Tabs

-

Inventory

-

User Experience

-

Notices

-

Order Rules & Segments

-

Links & QRs

-

Location Settings

-

Reports

-

Pack & Route

-

Displays

-

Users

-

Finance & Accounting

-

Cash

-

Gift Cards

-

Hardware

-

Labor Management

-

GoTab Apps

-

GoTab Marketplace

-

Event Deposits

-

EasyTab

-

Payment Terminals

-

Product Spotlight

-

GoTab Manager Dashboard Announcements

How to view your GoTab Accounting Reports

NOTE: Accounts can now be viewed in aggregate across multiple locations. If you have access to multiple locations you can select “All Locations” from the dropdown rather than an individual location to view all data.

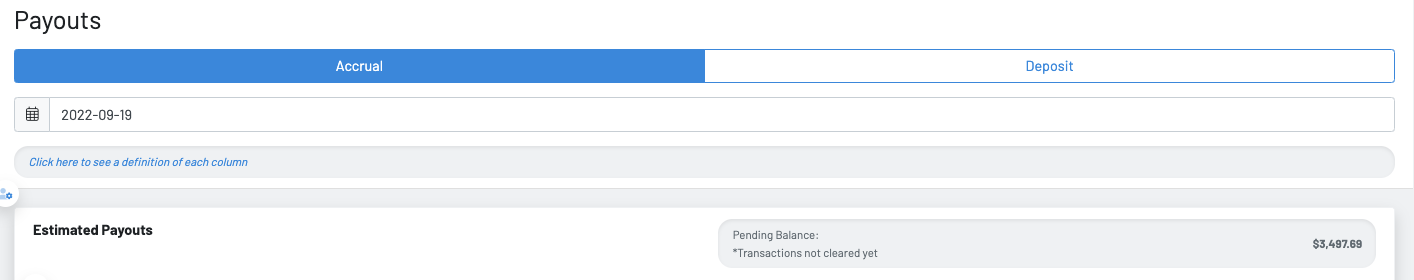

Managers can now view accounting data in two different ways (detailed below):

1. Accrual basis accounting- Revenue is recorded when it is earned. This report is made up entirely of transactions that take place on a single business day. Unpaid tabs (outstanding balances) are recorded in the Accounts Receivable category while payments made against outstanding balances are recorded in the Funds Received category.

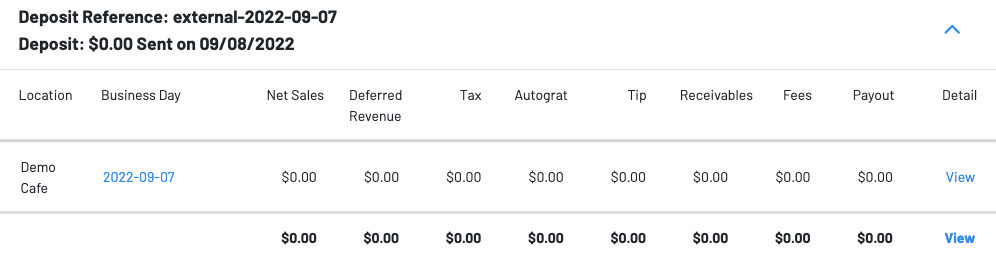

2. Deposit view- Payouts are recorded under the deposit view. This report is made up of entire payouts for any given location.

If you have any questions regarding this release, please do not hesitate to contact us at support@gotab.io or reach out to your Account Manager.